Navigating the world of currency exchange can feel like trying to find a needle in a haystack, especially when it comes to the CAD to USD exchange rate. One minute it’s soaring high, and the next it’s plummeting faster than a lead balloon. If you’ve ever wondered how the Canadian dollar stacks up against the US dollar on any given day, you’re not alone.

Understanding these fluctuations isn’t just for the finance nerds; it’s crucial for anyone who’s planning a trip, making investments, or simply curious about how their maple syrup stacks up against American pancakes. Dive into the details of past exchange rates, and you might just uncover some surprising trends—and maybe even a few laughs along the way. Buckle up as we explore the ups and downs of the CAD to USD exchange rate by date.

Table of Contents

ToggleOverview of CAD to USD Exchange Rate

The CAD to USD exchange rate exhibits frequent fluctuations influenced by economic indicators, market sentiment, and geopolitical events. Historical data shows how this exchange rate varies considerably over time. Major events, such as financial crises and trade negotiations, impact these rates significantly.

Tracking historical exchange rates allows businesses and individuals to make informed decisions. For instance, a dramatic rise or fall in the CAD to USD exchange rate can influence travel expenses or investment strategies. Observing patterns in monthly or yearly data helps identify trends that traders might capitalize on.

Statistical evidence reveals specific values of the exchange rate on various dates, illustrating its past behavior. With recent developments, such as shifts in oil prices or changes in interest rates, previously established trends can alter rapidly. Investors often monitor these changes continuously to adjust their strategies accordingly.

Incorporating historical exchange rate data offers insights into potential future movements. Some may find it useful to explore online calculators that provide live data for real-time decisions. Continuous research and understanding the market context can enhance knowledge about the CAD to USD relationship.

Utilizing reliable sources, such as financial news outlets or government reports, ensures access to current and accurate information. This comprehensive analysis supports a deeper understanding of the dynamics at play in the currency market.

Historical Trends of CAD to USD Exchange Rate

The CAD to USD exchange rate showcases fluctuations influenced by various economic factors over time. Examining historical trends reveals pivotal moments that shape the currency’s value.

Key Dates and Events

Several key dates highlight significant fluctuations in the CAD to USD exchange rate. For instance, in July 2008, the rate peaked at 1.10, driven by surging oil prices and a robust Canadian economy. In contrast, during the financial crisis in 2009, the rate dipped to 1.45 as investor confidence waned. Notably, trade negotiations between Canada and the U.S. in 2018 created further volatility, with the exchange rate oscillating between 1.25 and 1.30. Major elections, such as the 2020 U.S. presidential election, also impacted market sentiment and the exchange rate. Understanding these significant events helps gauge future trends.

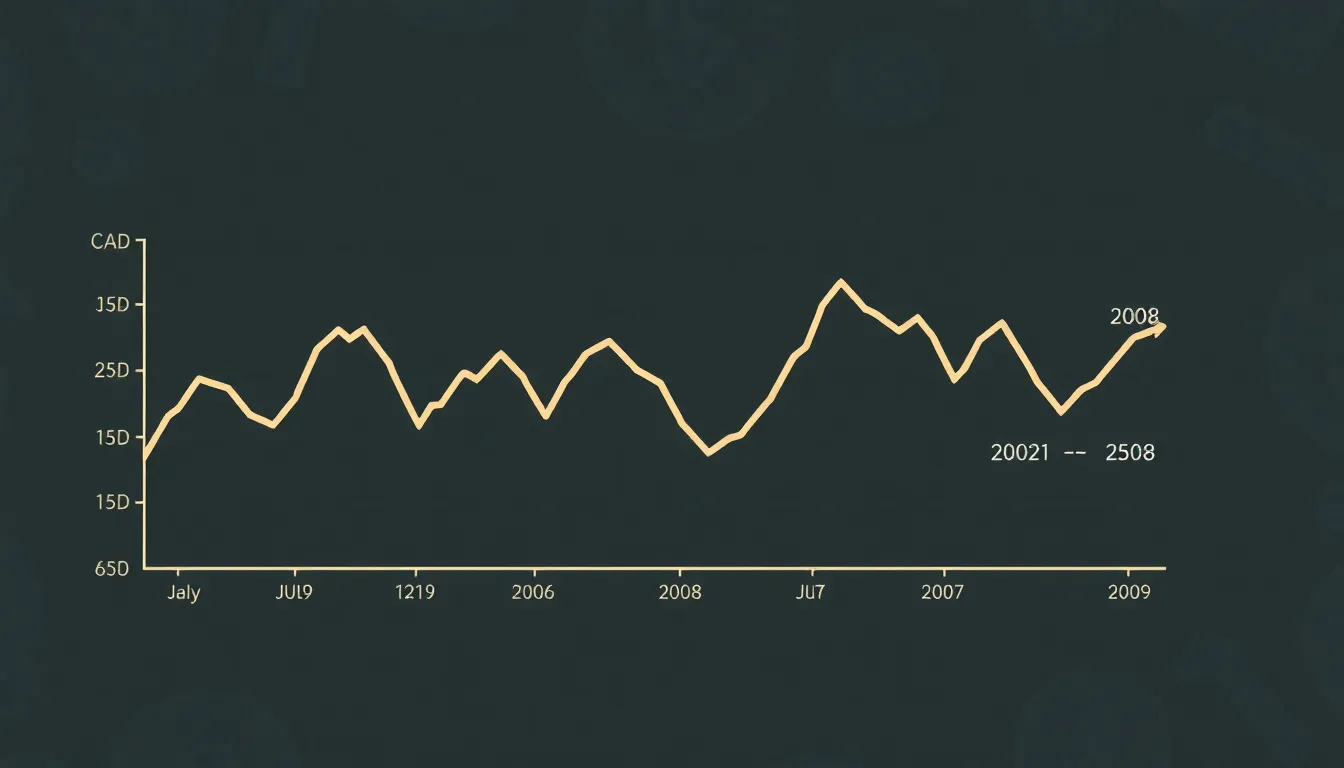

Visual Representation of Historical Data

Visual representations effectively capture the historical trends of the CAD to USD exchange rate. Graphs and charts illustrate fluctuations over specific periods, allowing for easier identification of patterns. For example, a line graph showing movements from 2010 to 2023 indicates overall appreciation of the Canadian dollar against the U.S. dollar post-2020. Bar charts can also depict monthly average rates, emphasizing seasonal trends and anomalies. Utilizing these visual tools aids in a clearer understanding of currency dynamics, enhancing decision-making for travelers and investors alike.

Factors Influencing the Exchange Rate

Various factors shape the CAD to USD exchange rate. Economic conditions, political developments, and market sentiment all contribute to fluctuations.

Economic Indicators

Economic indicators play a crucial role in determining the exchange rate. Gross Domestic Product (GDP) growth rates reflect a country’s economic health. When Canada’s GDP grows robustly compared to the U.S., it strengthens the CAD against the USD. Employment figures also matter; rising employment can signal a strong economy, thus boosting the Canadian dollar’s value. Interest rates set by central banks influence currency strength. For instance, if the Bank of Canada raises interest rates, it may attract greater investment, leading to CAD appreciation. Inflation rates further impact purchasing power, affecting exchange rates directly. Investors monitor these indicators closely, as they offer insights into future currency movements.

Political Events

Political events significantly affect the CAD to USD exchange rate. Trade agreements and negotiations can create uncertainty, leading to currency volatility. For example, the negotiations between Canada and the U.S. can lead to shifts in market confidence. Elections also play a part; changes in leadership can lead to unpredictable economic policies, impacting the exchange rate. Geopolitical tensions, both local and global, can create risk aversion among investors, causing the CAD to fluctuate. The impact of fiscal policies and government stability on currency valuation cannot be understated. Investors analyze these political dynamics to gauge their potential effects on the exchange rate.

Predictions for Future Exchange Rates

Predictions regarding the CAD to USD exchange rate involve analysis from financial experts and statistical models. Various factors influence these forecasts, which aid decision-making in currency trading and investment.

Expert Opinions

Expert analysts often look to macroeconomic indicators for insights into future exchange rate movements. Economists emphasize the importance of trade balances, interest rates, and central bank policies in shaping currency values. Monetary policy changes in either Canada or the United States can significantly sway market sentiment and, consequently, exchange rates. Some experts predict fluctuations driven by oil price changes, given Canada’s resource-heavy economy. Timing and geopolitical tensions can also introduce volatility. Overall, opinions vary, but consistent analysis remains crucial for anticipating future rate shifts.

Statistical Models

Statistical models provide a structured approach to predicting exchange rates based on historical data. Regression analyses frequently assess relationships between the CAD and USD against various economic indicators. Seasonal trends show how certain periods may reveal consistent exchange rate behaviors, aiding traders in strategic planning. Machine learning algorithms are becoming increasingly common, as they analyze vast amounts of data for pattern detection. These models use past performance to gauge future movements, improving accuracy in forecasting. Relying on statistical data equips investors and travelers with necessary insights for informed decisions.

Understanding the CAD to USD exchange rate is crucial for anyone navigating the complexities of currency fluctuations. By examining historical data and recognizing key influences such as economic indicators and political events, individuals can make informed decisions whether they’re traveling or investing.

The insights gained from past trends and current developments empower travelers and investors alike to adapt their strategies effectively. Continuous monitoring of the exchange rate, along with reliable sources of information, ensures that they stay ahead in a dynamic market. As the currency landscape evolves, staying informed will always be a valuable asset.